German factory orders unexpectedly dropped for a second month in December, adding to signs that Europe’s largest economy is facing a more protracted loss in momentum, Bloomberg writes.

The 1.6 percent decline, the steepest in six months, may feed speculation that Germany, once Europe’s major growth engine, contracted in the final quarter of 2018. Since the statistics office predicted a “slight” increase in gross domestic product, data have painted a more downbeat picture, and Deutsche Bank argued on Tuesday that the German economy was drifting toward recession amid deteriorating business sentiment.

Even though bulk orders were below average in December, the slump still “suggests that the weak phase in industry will continue for now,” the Economy Ministry in Berlin said in a statement. “The latest sentiment indicators also point to muted momentum at the start of the year.”

The euro dropped after the report and traded at $1.1387 at 8:49 a.m. Frankfurt time, down 0.2 percent on the day.

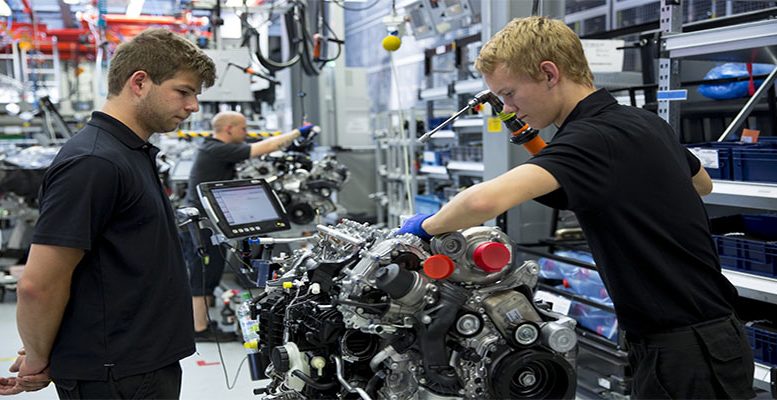

Chiefly responsible for the latest drop was weak demand for investment goods from outside the 19-nation euro area. Orders were down 7 percent from a year earlier, the most since 2012.

There report also held some slightly encouraging news. Orders rose 0.3 percent in the fourth quarter, helped by demand for investment goods. With car manufacturers making progress in adapting to new emissions tests, demand in that segment was up 10.2 percent.

The most recent business surveys suggest the situation in Europe’s largest economy has gone from bad to worse. A report by IHS Markit showed that German manufacturing shrank for the first time in four years at the start of 2019. That suggests the economy will contract this quarter, according to Deutsche Bank economists.

Bundesbank President Jens Weidmann said last week that he expects significantly lower growth in 2019 than only a few weeks ago as companies battle multiple uncertainties from a trade war to Brexit to a slowdown in China. The economy should be back to its cruising speed next year as it overcomes its temporary weakness, he said.

“The latest data show that the deflation of industrial books, which already started in the first half of 2018, gained new momentum toward the end of the year,” said Carsten Brzeski, chief economist at ING Germany. “Any rebound of industrial activity in Germany will be slow and sluggish.”

Comments are closed for this post.