Businessman Trifun Kostovski is convinced that the then interim Prime Minister Oliver Spasovski and the National Bank are behind the bankruptcy of his Eurostandard Bank.

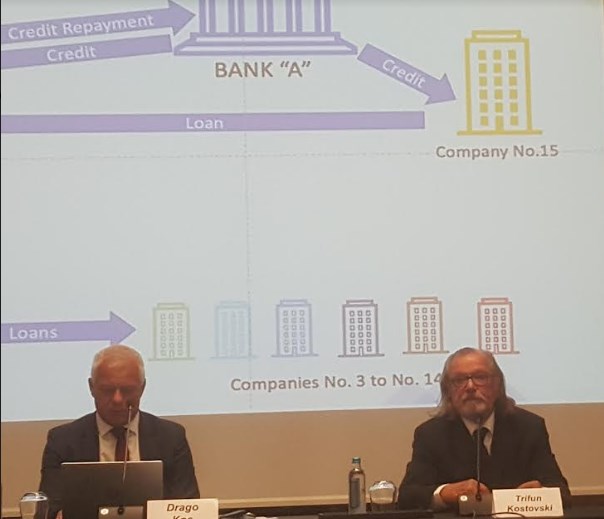

This is the conclusion after the report presented yesterday by two independent experts from Croatia and Slovenia, Drago Kos and Irena Francetovic. They explained in detail how the bank was destroyed and that former employees of the bank in prominent positions were implicated in it and and Komercijalna Bank, to which the “small” Eurostandard bank gives a deposit, is also played a part in it.

The suspicion that the technical government was also put in place to destroy Eurostandard Bank is even stronger with the fact that just 3 hours before the announcement of the bankruptcy by Mrs. Governor Bezoska on August 12, 2020, a member of the shareholders of Eurostandard Bank had a personal meeting with then interim Prime Minister Oliver Spasovski, Kostovski said on Monday.

The experts came to the knowledge that since 2004, in the Republic of Macedonia, there is a well-established scheme through which several commercial banks in the country systematically violated the applicable regulations in the field of banking, in order to be able, in addition to legally permitted lending, to carry out legally prohibited lending, mostly for entities that are not eligible for obtaining bank loans.

The scheme worked in such a way that a certain bank identified companies willing to give up their business accounts, to which the bank then paid certain amounts based on fictitious credit agreements, and then the same companies formally lent those amounts to other companies, exclusively by choice and in the organization of the bank. In a similar way, these funds were then returned to the bank. In that way, the bank benefited from the artificially increased credit placements, paid commissions, interest, penalty interest and other costs, while the companies that played the role of transmitters of illegally acquired money, i.e. converting credits into loans, due to the exceptional scale of the scheme which did not allow the possibility for exercising control, they usually suffered serious losses, the report states.

In the report, there is a special place for the role of the National Bank, which, as experts say, “refuses to recognize and prevent the existence of the scheme” to destroy the bank.

The National Bank should have initiated bankruptcy proceedings in August 2019, when the capital adequacy ratio – according to the National Bank’s own findings – was already negative, but it still did not do so. Apparently, the National Bank had a very clear understanding of the mandatory provisions of the Law on Banks regarding its discretion right to initiate bankruptcy, but it waited until August 12, 2020 to initiate bankruptcy. Strictly legally and according to the data available to the National Bank on the capital adequacy ratio of the Eurostandard Bank on June 30, 2020 – despite the fact that it was not clear what the real capital adequacy ratio actually was – it should have initiated bankruptcy proceedings on that date. Considering the fact that no bankruptcy proceedings were initiated in August 2019, there are serious doubts as to whether the moment of initiation of bankruptcy proceedings on August 12, 2020 was appropriately chosen, experts believe.

Comments are closed for this post.