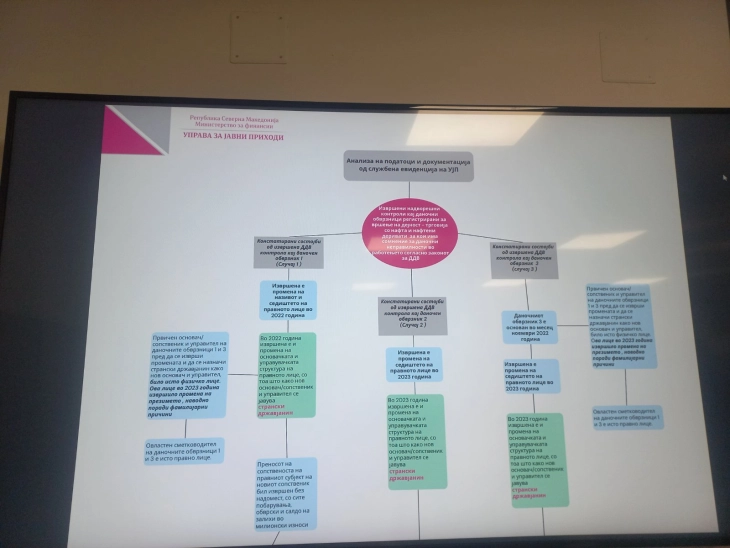

On Monday, the Public Revenue Office (PRO) disclosed detailed information regarding the deceptive practices employed by oil companies to secure a Value Added Tax (VAT) refund through personal income tax channels.

The PRO conducted audits on three companies engaged in wholesale and retail trade of oil and its derivatives. These entities sought to manipulate the legal landscape by altering their corporate identity and headquarters, as well as restructuring ownership and management, all while lacking registered employees, necessary licenses from the Energy Regulatory Commission, a gas station, and a warehouse. Fictitious invoices, amounting to millions of denars, were instrumental in their deceitful endeavors.

PRO Director Sanja Lukarevska emphasized that the national budget remained unharmed, as vigilant tax officers thwarted VAT refunds totaling approximately Mden 160 million (EUR 2.6 million) and personal income tax amounting to Mden 19 million (EUR 308,000).

In response to these findings, the PRO submitted compelling evidence to the Ministry of Interior on November 15, 2023, and to the Financial Police Office on December 1, 2023.

With regard to the solidarity tax, the PRO undertook the enforcement of its collection from eight taxpayers, successfully completing seven procedures already.

Comments are closed for this post.